IMPORTANT DRIVER LICENSE TESTING REQUIREMENT:

As mandated by State Policy from Tallahassee, effective Friday, February 6, 2026, all driver license exams, including Written Tests and Road Tests, will be administered in English only. For more information, please visit www.FLHSMV.gov.

If you need to cancel, reschedule or otherwise change your appointment, please visit www.polktaxes.com (click on Make Appointment to cancel/reschedule) or call 863-534-4700.

We hate to have you wait. Don't stand IN line. Renew ONLINE! Tax Collector Service Center lobbies are crowded. We are experiencing a great increase in customer traffic per day. Try renewing ONLINE!

- Driver License or ID renewals CLICK HERE

- Vehicle Registration renewals CLICK HERE

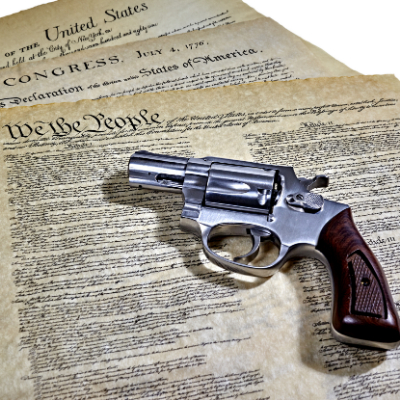

Appointments required for the following services: The Tax Collector's Office requires appointments for all driver license services (written and road tests, license and ID card issuances) and concealed weapon license services. To make an appointment, click on the "MAKE APPOINTMENT" button above.

Joe G. Tedder welcomes you...

Thank you for visiting PolkTaxes.com, the official website of the Tax Collector’s Office for Polk County, Florida. At PolkTaxes.com we are focused on providing quick access to online payment services and information. As you make your way through our website, please know we want to hear about your experience, including how we can improve. We truly seek to earn the public's trust and confidence and know that your input is valuable in making that happen. Again, you have my thanks for allowing us to serve you! Click here to tell us how we are doing at PolkTaxes.com.

Our Services

Appointments

The Tax Collector’s Office has an online appointment system designed to make it easy to schedule appointments for all Driver License, ID Card, and Concealed Weapon License services.